Commercial Hard Money Lenders: How To Get A Loan With Rotten Credit

Commercial Bridge Loan: How To Evaluate Risks vs. Benefits

July 7, 2016Commercial Hard Money Lenders: How To Get Your Loan To Close Swiftly

July 7, 2016Commercial Hard Money Lenders: How To Get A Loan With Rotten Credit

Rotten Credit Keeping You From Getting A Loan? Try Applying

With Commercial Hard Money Lenders!

Poor credit can prevent many from even applying for a

commercial loan, but it doesn’t need to. There is an option that is still

available through commercial hard moneylenders.

commercial loan, but it doesn’t need to. There is an option that is still

available through commercial hard moneylenders.

People make mistakes with money. It happens. You don’t mean

to (or maybe you did). Sometimes life just throws too many problems at you, and

you couldn’t see another way out—or maybe you and your credit card were the

life of the party in college.

to (or maybe you did). Sometimes life just throws too many problems at you, and

you couldn’t see another way out—or maybe you and your credit card were the

life of the party in college.

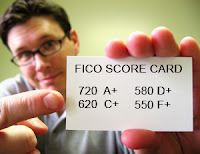

So you developed bad credit while you were in college or

your younger years. Now you are a responsible, hard-working adult that just

wants to open your own business and be your own boss. It’s the American dream.

Too bad your rotten credit rating is keeping you from getting approved for a

traditional commercial loan.

your younger years. Now you are a responsible, hard-working adult that just

wants to open your own business and be your own boss. It’s the American dream.

Too bad your rotten credit rating is keeping you from getting approved for a

traditional commercial loan.

But there is a solution to your problem—commercial hard money lenders!

What Is A Commercial Hard Money Lender?

Don’t worry–you are not dealing with your local loan shark.

So you don’t have to worry about someone trying to take out your kneecaps if

you miss a couple of payments. No, commercial hard money lenders are legitimate, private individuals or companies that

loan money to people and businesses with rotten credit who can’t get approved

for a traditional loan.

So you don’t have to worry about someone trying to take out your kneecaps if

you miss a couple of payments. No, commercial hard money lenders are legitimate, private individuals or companies that

loan money to people and businesses with rotten credit who can’t get approved

for a traditional loan.

Loans are secured by commercial property and will have

higher interest rates than conventional loans. Since there is more risk involved

for lenders, they can charge higher interest rates. It is not unusual to see a

lender charge 11-13 percent and three points.

higher interest rates than conventional loans. Since there is more risk involved

for lenders, they can charge higher interest rates. It is not unusual to see a

lender charge 11-13 percent and three points.

If you want to go into business for yourself, it is a cost

you have no choice but to accept. You may hesitate because you don’t want to

risk having your business foreclosed on, but lenders don’t want to foreclose on

your property if they can at all avoid it. When they do, it is not unusual for

them to lose money—and no one wants to lose money.

you have no choice but to accept. You may hesitate because you don’t want to

risk having your business foreclosed on, but lenders don’t want to foreclose on

your property if they can at all avoid it. When they do, it is not unusual for

them to lose money—and no one wants to lose money.

Beware The Fees And the Dreaded Balloon Payment!

Commercial hard money lenders are not going to be willing to wait 10-30 years to get their money

back. They give short term loans; typically for a year, but maybe as long as

three years. With the interest rates being as high as they are, if you can, it

is not a bad idea to try and pay the loan off early—that is, unless there is an

exit fee or prepayment penalty.

back. They give short term loans; typically for a year, but maybe as long as

three years. With the interest rates being as high as they are, if you can, it

is not a bad idea to try and pay the loan off early—that is, unless there is an

exit fee or prepayment penalty.

While it may sound strange to be penalized for paying a loan

off early, lenders make money when you pay interest. If you pay the loan off

early, you don’t pay as much interest. So to recoup this loss, some will charge

a prepayment or early payment penalty.

off early, lenders make money when you pay interest. If you pay the loan off

early, you don’t pay as much interest. So to recoup this loss, some will charge

a prepayment or early payment penalty.

Some will even charge exit fees whether you are paying the

loan off early, late, or on time. This way lenders make a little more money off

of you.

loan off early, late, or on time. This way lenders make a little more money off

of you.

You will want to know if your loan has a balloon payment at

the end. Where these can sting is if you are paying your loan off late, like

many hard money loans often are. So along with the balloon payment you get

stuck with a hefty late fee making it even more difficult to get the loan paid

off.

the end. Where these can sting is if you are paying your loan off late, like

many hard money loans often are. So along with the balloon payment you get

stuck with a hefty late fee making it even more difficult to get the loan paid

off.

Dennis Dahlberg Broker/RI/CEO/MLO

Level 4 Funding LLC

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

Dennis@level4funding.com

www.Level4Funding.com

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

Dennis@level4funding.com

www.Level4Funding.com

NMLS 1057378 | AZMB 0923961 | MLO 1057378

22601 N 19th Ave Suite 112 | Phoenix | AZ | 85027

22601 N 19th Ave Suite 112 | Phoenix | AZ | 85027

111 Congress Ave |Austin | Texas | 78701

About the author: Dennis has been working in the real estate industry in some capacity for the last 40 years. He purchased his first property when he was just 18 years old. He quickly learned about the amazing investment opportunities provided by trust deed investing and hard money loans. His desire to help others make money in real estate investing led him to specialize in alternative funding for real estate investors who may have trouble getting a traditional bank loan. Dennis is passionate about alternative funding sources and sharing his knowledge with others to help make their dreams come true.

Dennis has been married to his wonderful wife for 42 years. They have 2 beautiful daughters 5 amazing grandchildren. Dennis has been an Arizona resident for the past 40 years.